Similar to how people use mortgages to spread the cost of a house to make it affordable, councils use debt to pay for large and long-life infrastructure, so the cost is spread over all the people who will use it now and in the future.

While major projects such as a new water pump station, a replacement bridge or a museum carry a significant upfront price tag, we spread the cost out over a number of years, so it is paid by all the people who will use it over time.

This means that these large capital projects have less effect on your annual rates bills than our day-to-day costs. There are two important numbers when it comes to Council debt.

All our lending comes via the Local Government Funding Agency, which allows us to borrow up to 2.8 times our operating income (280%). This is the maximum amount of debt we can take on, so in total this would be about $485 million in this ten-year plan based on our projected rates increases.

The second number is our self imposed debt cap, which currently sits at 2.1 (210%) times our income or about $280.3 million. This means we still have some headroom, just under $100 million if something significant like a natural disaster occurs

However, at the 2.1 cap we can’t deliver everything that is planned over the life of this plan and keep rates rises at a reasonable level.

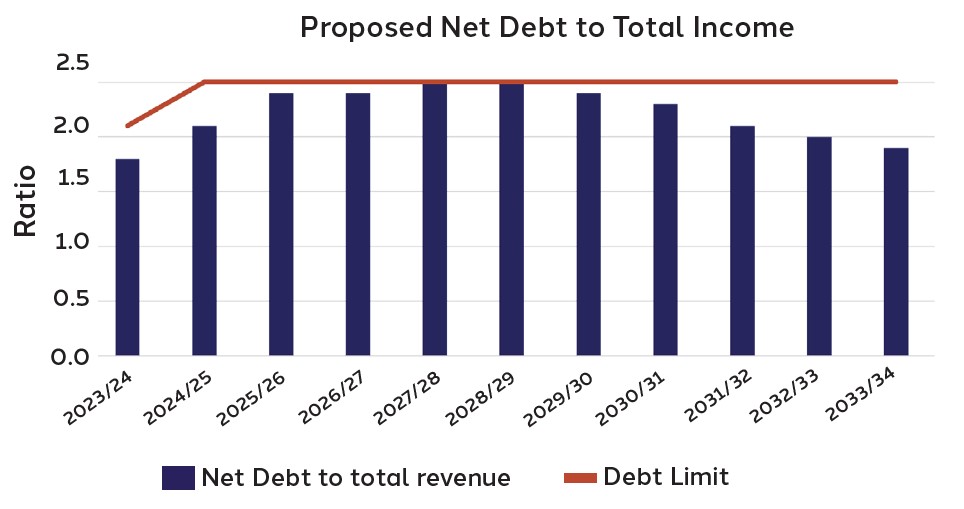

Our preferred option is raising this cap to 2.5 (250%) times our income. If you look at the graph below, you’ll see that we get close to this cap for a few years, then it begins to go down as we get back into surplus and start paying down debt.

Our overall amount of debt will increase, but we will still have a significant amount of headroom in case of a disaster, such as the Rangitata floods we experienced recently.

We want to know how comfortable you are with our plan to raise the debt cap to 2.5.