Financial-Strategy 2024-34

Updated 10 Apr 2024Financial Strategy

Download a copy of our Financial Strategy

Download a copy of our Financial Strategy

Financial-Strategy 2024-34

Updated 10 Apr 2024

The 2024-2034 Long Term Plan budget was developed to prioritise core services, business operations, and deliver Council priorities.

The Council has committed to sustaining current service levels, upgrading community facilities, and addressing climate change, so this budget allocates more funding to asset renewal and replacements.

This Financial Strategy complements our Infrastructure Strategy

and relies on our Significant Forecasting Assumptions and Activity

Statements.

Together, these detail Council’s plans to achieve its key outcomes

and address the pressing challenges outlined above.

The Infrastructure Strategy and forecasting assumptions outline the

context, while the Activity Statements detail steps for realising our

financial and infrastructural goals. This integrated planning supports

Council in delivering results.

The Financial Strategy aims to get the balance right so that

we can achieve our goals of:

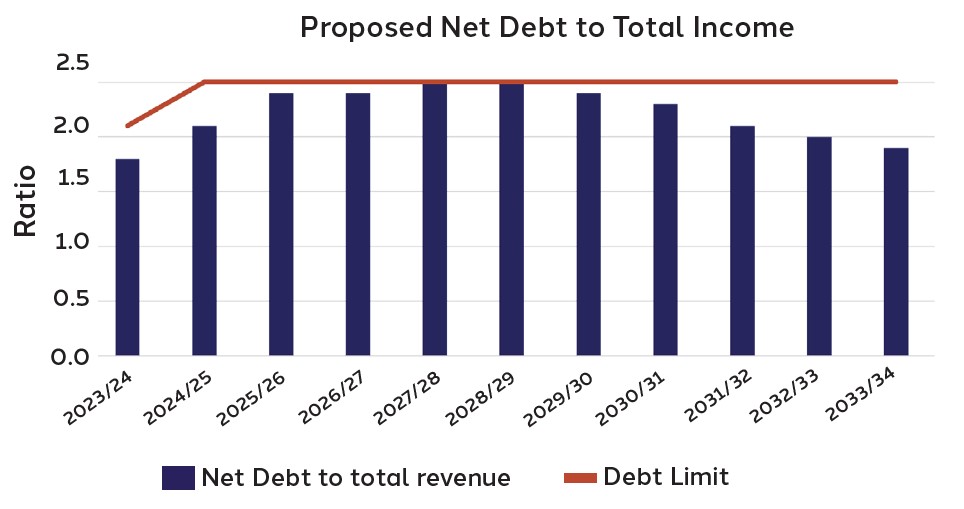

The long-term debt-to-revenue limit is proposed to be raisedto 250% for the 2024/2025 fiscal year and remains at that level for the rest of the Long Term Plan.

Over the 10-year period, Council is allocating $650 million towards capital projects, with the majority (80%) of the investment going into water services and roading renewals, and a smaller share (20%) going to community facilities. This capital investment delivers on objectives to upgrade assets, improve amenities, and enable quality services.

Although our maximum allowable debt level is 280% (2.8 times) of operating revenue, this Financial Strategy caps our normal debt operating limit at 250% (2.5 times) or lower - aligned with New Zealand Local Government Funding Authority (LGFA) thresholds.

By staying below the 250% limit over the life of this long term plan,

we are likely to retain Council’s strong AA- credit rating.

Generating consistent budget surpluses is required to service existing debts and continue investing in infrastructure.

This Financial Strategy targets a balanced budget or surplus from the fourth year onward.

Through the plan timeframe, Council will continue to seek expenditure control and efficiency gains across all its operations.

Projected rates from 2030 forward will produce surpluses to pay down existing debts.

The overall increase in rate collected is proposed to be 15% in 2024/25, 12% in 2025/26 and 12% in 2026/27. From 2027/28 onwards, rate increases will not exceed 5%. The average annual rates increase over the ten year period is 7.4%.

The Council considers that its overall rating system represents the most appropriate option to address the present and future needs of the

district.

A new targeted rate has been introduced for 2024/25 onwards:

The average increase in rates collected represent the minimum viable levels Council needs to fund planned capital investments and maintain existing levels of service. Since borrowing capacity depends on debt ratios, rising interest costs would require higher rates.

These budgets enable our capital projects to be completed, sustain existing levels of service, and generate surpluses for debt payments within the overall debt constraints.

Council has struck a prudent balance, which enables investment for present and future needs while maintaining affordability. Rates from district growth (new housing developments and business investment) are pivotal within the financial strategy.

Total rates revenue grows an average 0.5% annually over the 10-year span due to this growth. Lower than anticipated growth could impact our capital plans, as baseline rates from existing properties could not solely fund intended investments.

Council is proposing to add a targeted rate to 275 properties within the CBD for a Business Improvement District Rate of $120,000 per annum; to be used for CBD specific activities.

Council is proposing to increase these rates by $1 per annum as agreed by the Community Boards to meet the increased requests and costs for support for community projects.