In this section

Powering up our investments – proposal to sell shareholding in Alpine Energy Ltd

We want to know what you think about the proposal by Timaru District Holdings Limited (TDHL) to sell its shareholding in Alpine Energy Limited.

You can now read the public submissions on the proposal here.

The Council agenda (including officer comments on submission topics) for the meeting starting on Tuesday 18 December can be found below:

What are we proposing?

TDHL is proposing the sale of its 47.5% shareholding in Alpine Energy Ltd and using the funds to repay some of Council’s debt and reinvest the remaining funds in a more diversified range of investments or other strategic investments.

Why?

The Council believes the funds that are invested in Alpine Energy can be used more effectively for the long term prosperity and development of Timaru District. The funds would be invested in such a way that the returns to Council would be higher, and the risk associated with the investments would be lower.

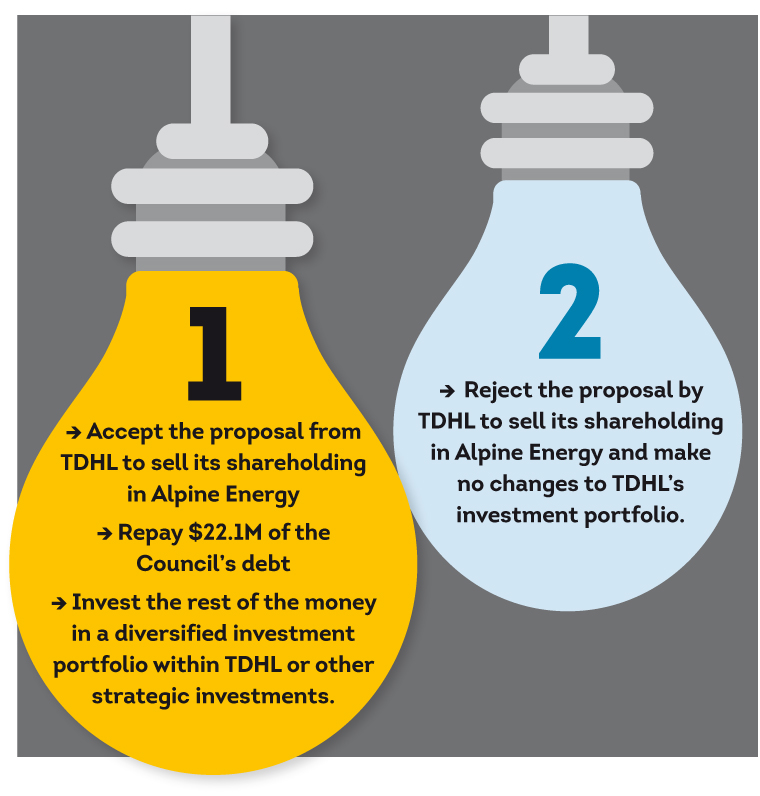

Options

Consultation Document and Long Term Plan 2018-28 Amendment

Download a copy of the Consultation Document below or pick up from council offices, libraries or service centres.

Timetable

| Submissions Open | 8 November 2018 |

| Submissions Close | 5pm, 10 December 2018 |

| Council Hearing | 18 December 2018 |

| Final Decision | December 2018 |

Submission Information

Submissions have now closed. Thanks to all who have made submissions. Submissions are available to read on the website here.

Submissions will be heard on Tuesday 18 December 2018.

Please note your submission will be available to the public and media as it will be part of the Council’s decision-making process. If you need any assistance, please contact Council at (03) 687 7200.

Alpine Energy Proposal - the details in a nutshell

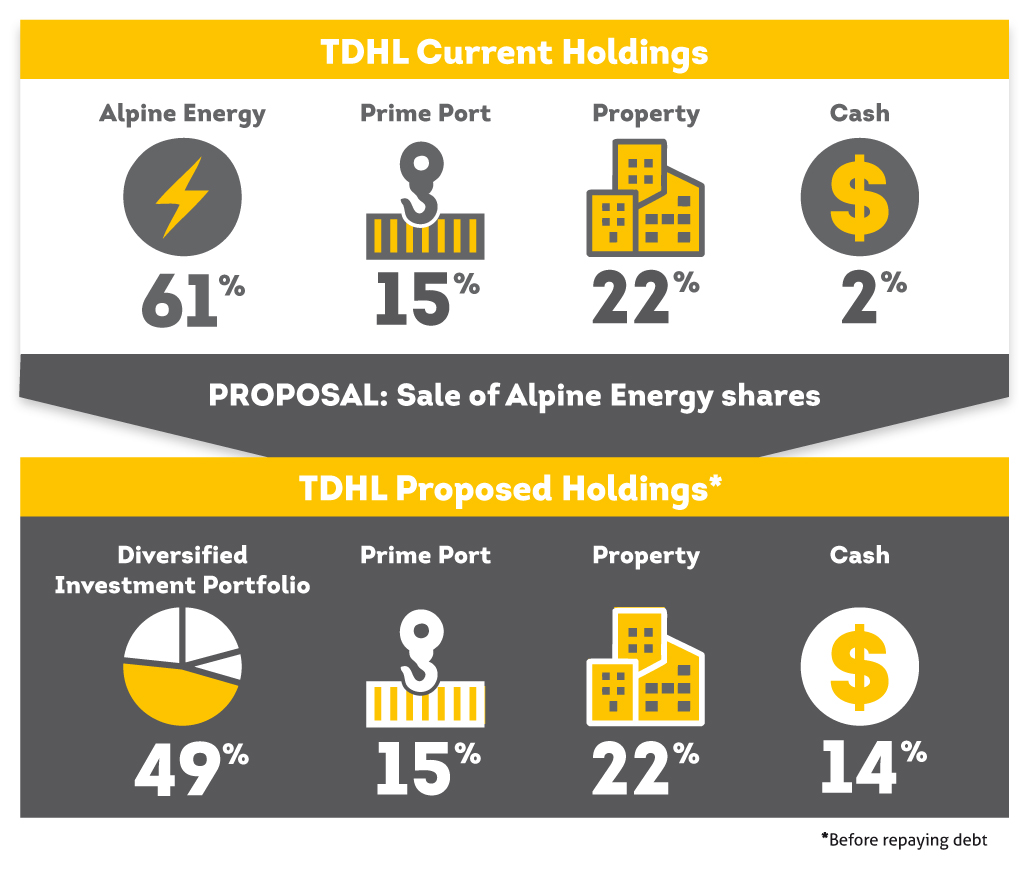

- The Council has a range of investments that are managed on its behalf by TDHL.

- TDHL is a wholly owned subsidiary of Timaru District Council that manages Council’s commercial assets.

- Council’s Alpine Energy shares represent 61% of TDHL’s total assets.

- This current investment generates an average $2.85million annual return to Council.

- The proposed sale of Council shares in Alpine Energy Ltd is expected to return at least $110 million.

- With these funds TDHL will repay a $22.1 million debt to Council. This will in turn allow Council to repay $22.1 million of its own external debt resulting in $1.1 million interest savings per year, commencing from 2019/2020.

- The remaining funds, estimated to be at least $88 million, will be placed in a professionally managed diversified long term investment portfolio, or other strategic investments. Assuming a range of investment returns, the initial $88 million investment could potentially increase to between $106 million and $154 million over a 10 year period.

- As well as potentially generating higher returns, a more diversified investment portfolio is considered to be a lower risk investment.

Frequently Asked Questions

Click here for Frequently Asked Questions.

What will these options mean?

1. Sell the 47.5% shareholding in Alpine Energy

| Advantages | Disadvantages |

|---|---|

| The sale of the Alpine Energy shareholding will provide TDHL and the Timaru District Council with a number of strategic options for the use of these funds including: - Reducing Council’s debt; - Generating a capital sum of money to create long-term wealth; - Increasing the ability to reduce reliance on rates for capital expenditure; - Building up a large capital fund in TDHL that can be used to finance future projects in the community; - Funding regional projects not already identified in the Long Term Plan. | A TDHL sale of all its shares in Alpine Energy will result in a loss of any influence on strategic initiatives and direction of Alpine Energy. (Note: A 47.5% shareholding does not give TDHL control over Alpine Energy, TDHL is limited to two out of five directors.) |

| Funds received from a sale of Alpine Energy shares will allow TDHL to diversify its portfolio of investments and lower the risk on its investments. | If TDHL does not have any shares in Alpine Energy it would not benefit from any potential future growth from Alpine Energy activities. (Note: Council considers this is not a big disadvantage. Most of Alpine Energy’s business comes from its lines business. Other parts of Alpine Energy’s business carry higher risk to TDHL.) |

| A full sale process of the total shareholding would result in a fair sale price for the shares. A partial sale would leave TDHL with a minority shareholding with even less influence. | If TDHL retains its existing shareholding in Alpine Energy it would continue to receive distributions (by way of dividends) of approximately $4.7m per year after tax. (Note: TDHL will still receive income from its investments and expects this will not be less than it currently receives from Alpine Energy.) |

| A diversified investment portfolio created from a sale could enable TDHL to generate greater returns than those currently received from Alpine Energy. | Loss of the potential benefit to gain from any Alpine Energy’s future business developments should they become profitable. |

| Minimal impact on the consumers / residents and businesses of the Timaru District (and across South Canterbury). There will be no change to consumer protection as electricity line charges are regulated by the Commerce Commission, and consumers continue to hold an indirect interest via Line Trust South Canterbury. |

2. Keep the 47.5% shareholding in Alpine Energy

| Advantages | Disadvantages |

|---|---|

| TDHL will retain a stable and secure investment, including stable investment returns. | TDHL and the Council will not be able to take advantage of future strategic options, as outlined under the ‘Advantages’ above. |

| TDHL will retain some influence over Alpine Energy’s direction. | TDHL would lose the opportunity for maximising the return on its investments via investment diversification. |

| Retain the ability to gain from any Alpine Energy’s future business developments should they become profitable. | TDHL would not have the additional funds to repay the Council loan, meaning Council can not repay some of its debt and thereby reduce interest costs. |

| Minimal impact on the consumers / residents and businesses of the Timaru District (and in fact across South Canterbury). | TDHL would retain a single investment of significant value with the associated risk of having “all eggs in one basket”. |

Last updated: 12 Apr 2021