Published: 29 Jun 2018

Residential Rates

Here is a simple guide to the different charges that make up your rates bill, and what it goes to. Rates are a bit more complicated that was is often portrayed.

The overall increase in the rates collected by the council is 5.8% for 2018/19. This is not necessarily the increase that will apply to your individual rate bill.

The individual rates you pay in Timaru District are dependent on a number of factors, including:

- the value of the land you own

- what services you receive,

- where you live

- the type of property you have,

so everyone’s share may be slightly different.

But the story’s claim that people in certain towns will pay a specific amount more or less depending on the town they live in is inaccurate.

The increase in rates for individual properties is worked out considering the factors above.

This year also sees the new valuations being used when it comes to calculating your individual rates. The overall amount of money collected by the council doesn’t change due to the revaluation, but your share of it may a little.

How we work out your rates

For a standard residential property in one of our towns there are a few items that make up your rates bill:

- Uniform Annual General Charge (UAGC) - $677 per rating unit This flat charge covers the cost of providing community amenities such as libraries, swimming pools, parks, the cost of public responsibility, civil defence, environmental health, road and street landscapes, economic development and promotion and the airport.

- General rate – $0.00240 per dollar of land value

This covers the portion of Public Responsibility, Arts and Community Amenities, Civil Defence, Environmental Health, Road and Street Landscapes, Economic Development and Promotion and Airport costs not recovered by the UAGC plus Costs associated with the roading network, street lighting, refuse disposal services, dog control, building control, district planning and non-commercial property costs.

- Community Works and Services Rate –

Geraldine - $0.00150 per dollar of land value

Temuka - $0.00250 per dollar of land value

Timaru - $0.00135 per dollar of land value

Rural - $0.00005 per dollar of land valueThis covers the cost of community activities, such as non-subsidised roading (footpaths), stormwater drainage and community lighting. The money collected by this is spent in the community that pays it.

- Community Board Charges –

Geraldine - $3.00 per rating unit

Pleasant Point - $5.00 per rating unit

Temuka - $3.50 per rating unitThis covers the cost of providing specific Council services as determined by the Temuka, Geraldine and Pleasant Point Community Boards.

- Sewer Charge - $369.00 per rating unit

This flat charge covers the cost of providing sewerage disposal to those who are connected to the system.

- Waste Management Charge - $285 per rating unit for a standard 3 bin set

This covers waste collection if you receive this service.

- Water Charges Urban - $315.00 per rating unit.

This covers the supply of drinking water to your house.

For a residential property, your rates are made up of these items added together. If you live rurally you may pay different charges (e.g. if you are on a rural water supply scheme) or you may not pay some of these charges at all (e.g if you don’t receive the sewer service, you won’t pay this rate).

You can find out the value of your land by looking on the TDC website here: https://www.timaru.govt.nz/services/rates-and-property/property-search

Why your rates increase

The average household in Timaru District pays just less than $7 a day in rates. This covers all the costs of running the district, providing water and sewerage services, rubbish collection, street lighting, pools, libraries and a variety of other services.

It is possible to keep rates artificially low through deferment of maintenance and renewals. We don’t see this as a responsible approach, as it leaves future generations footing higher bills to fix larger issues.

The services we provide are also subject to increasing standards and expectations from improved water standards to environmental limits on discharges of stormwater and treated sewage.

The general ethos of Timaru District Council is to keep rates as low as possible but continue to move forward on a slow and incremental path, rather than defer rate rises and have a sudden large increase. We also carefully use long term loans to pay for major multi-generational infrastructure, ensuring residents now do not need to pay the full cost of something that will last a hundred years, and that future residents pay their fair share. These approaches ensure the council is on a sound financial footing.

How we spend it?

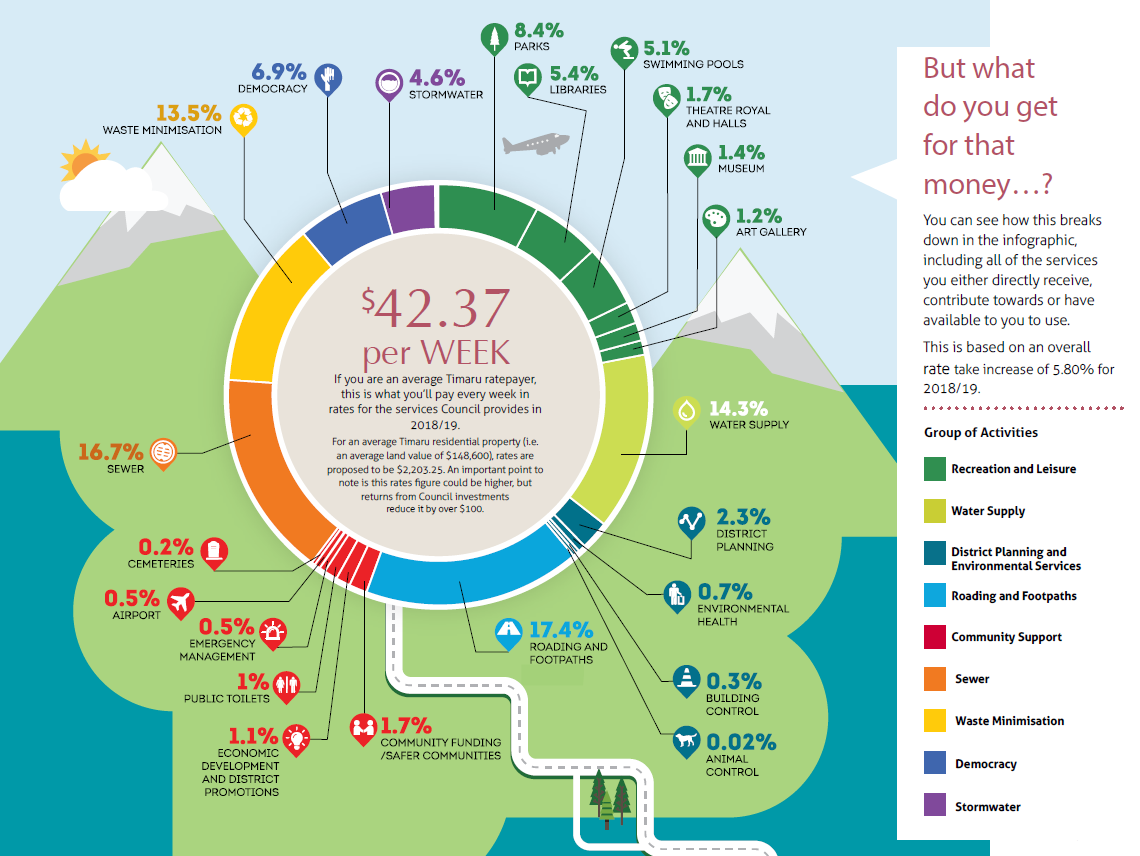

Here’s the breakdown of how rates money is spent in the district for an average Timaru residential property with a land value of $148,600. The core infrastructure of Roading, Water, Sewerage, Stormwater and Waste collection makes up nearly 67% of what this property pays.

Services such as building control, animal control and planning are mainly funded by users of the service through user charges. Other services, such as libraries and swimming pools are also partly paid for fees and charges, so only a portion of these services is rates funded.

As you see below, money obtained from Council investments also reduces the rates bill by over $100 for this property.

Last updated: 24 Feb 2021